The UK ends 2020 facing a bleak Christmas, with the twin threats of a third Covid wave, and Brexit uncertainty. The gloomy New Year prospects are for further economic chaos, rising business insolvencies, higher structural unemployment and mass financial hardship. Yes, the Chancellor Rishi Sunak has extended the furlough scheme to April along with the Business Loan scheme and the Bank of England has kept rates near zero and the liquidity pumps flowing . But these are short-term fiscal and monetary financial elastoplasts, while cheered by stockmarket investors, cannot give any much cause for optimism for the millions of small businesses and individuals who have been decimated by the pandemic.

But Covid has accelerated a number of economic trends that were already in place, most notably the rapid growth of the Digital economy, in areas such as E-commerce, remote working, fintech among others. These shifts are structural and not temporary, and the seeds for longer-term economic recovery and new opportunities for businesses and individuals is to embrace this digital transformation. Moreover, we would argue that rapid digitisation has also acted a fresh catalyst for re-new globalisation and greater access to cross-border economic opportunities.

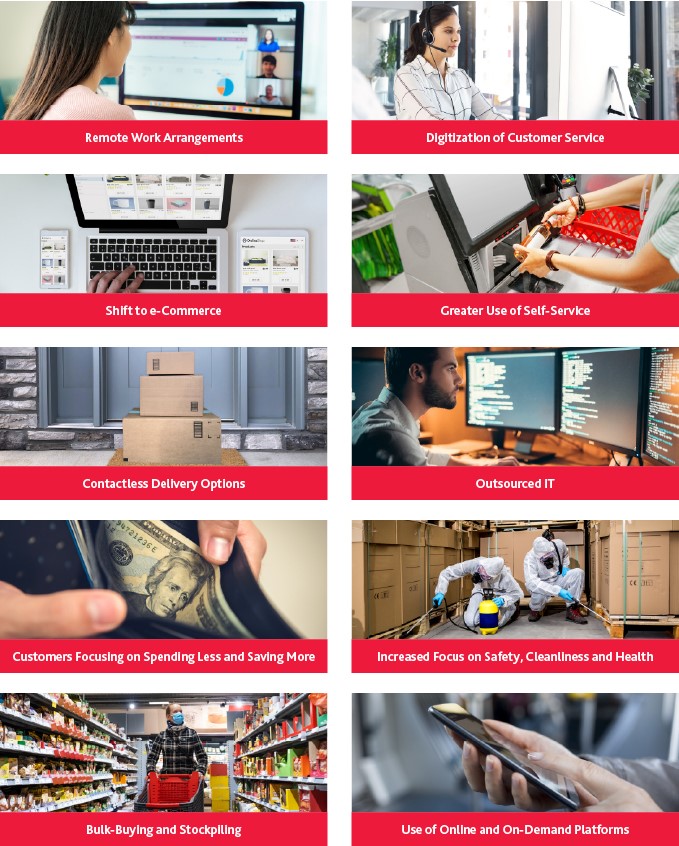

Let’s review some of the Digital tends Covid has accelerated amid lockdowns and the rise of remote working : 1) Omnichannel Commerce – Of course E-commerce has boomed as evidenced by the onwards march of the dominance of Amazon.com and its founder Jeff Bezos becoming the $ 200bn man. With greater constraints on going to physical shops, consumers have turned to online shopping to an even greater extent. While existing E commerce platforms have been the prime beneficiaries, businesses have been forced to embrace digital sales and engagement strategies such as better quality customer apps, payments and delivery services. 2) Digital Content Consumption – According to Statistica, 51% of internet users worldwide are watching video streaming services such as Netflix and self-generated content on Facebook, Youtube and Tik Tok has boomed; 3) “Platformication” – Businesses and institutions have embraced new digital platforms to keep engaged with customers – Fitness studios have gone online and some have boomed most notably Peloton bike classes. Digital health and E-learning have also boomed . And in addition to online classes for schools and universities, there is a rapidly growing market for E-learning for self improvement. People stuck at home want to acquire new work or life skills and digital learning platforms are making this easier.

Brian Wong, of Seacliff Partners, writing in a June, 2020 World Economic Forum Report noted that “The digital economy represents a departure from the traditional zero-sum-game business model with its focus on shared value creation. The digital services that people relied on during the outbreak like online marketplaces, cashless payment, contactless delivery and livestreaming will almost certainly become ubiquitous now…(and) The benefits of the digital economy will also see mass entrepreneurship spur on social mobility, and there will be greater economic participation from marginalized populations.” Moreover, in the light of the pandemic, Rana Foroohar of the Financial Times noted in a Oct, 2020, article that while there has been a rise in pandemic related insolvencies, it is also the case that there are many new digital businesses being created in the pandemic. She noted that “ In a pandemic, it is better to own a company built on customer data than one with bricks and mortar retail outlets. Indeed, it may turn out to be smarter to own companies rich in intangible assets from any sector rather than bet on the Big Tech companies that have been driving the S&P 500. This will be particularly true if regulators begin to pick apart the business models of Facebook, Google and the like.” Moreover, knowledge workers and asset light businesses dominate in the digital economy and the barriers to entry or the costs of creating new businesses has come down dramatically. There are also macroeconomic consequences for the rapid growth of digital businesses. Robert Kaplan, head of the Dallas Federal Reserve Bank. In a recent essay on US economic conditions and monetary policy in the wake of the pandemic, he noted how people’s work and shopping habits have changed. They are doing more online, which allows digital platforms to grow bigger, and this in turn has damped business pricing power. This is likely to keep inflation low and hence allow central banks to keep interest rates lower for longer. This is good news for financial markets and businesses alike, if not for savers.

Source: BDO

We would argue that both Covid and Brexit has increased the importance of economic engagement for the UK in fast growing developing countries such as Bangladesh. The latter’s economy has proved to be one of the most resilient to the Covid crisis with the IMF forecasting that for 2020, per capital income in Bangladesh will $ 1,887, above that of India for the first time. Coming back to the twin themes of the accelerated growth of the digital economy and renewed globalisation, let me give a few examples involving the UK and Bangladesh. Firstly, a New York based Non-Resident Based Bangladeshi, Faisal Alam, has launched a new E-Commerce company, Hubsdeal.com, providing a E-sales platform initially for the US and then in 2021 for the UK with the digital marketing platform based in Bangladesh. So Digital marketers and Digital content creators based In Bangladesh will be providing support for E commerce sales in the US and Europe. His vision is to create a whole new eco-system of digital entrepreneurs that can sell on Hubsdeal.com and other digital platforms such as Amazon.com, but using a large pool of low cost digital marketers from Bangladesh. At the same time, some Bangladeshi RMG companies, hurt by the buyers withholding orders and payments in the initial months of Covid, will, we believe, increasingly looking to sell directly to UK, US and European consumers directly with their own brands. Since much of these sales will be online, there is a need for re-sellers of such RMG products based in the UK.

Another company, Infiniti Technologies, started by a Non-Resident Tech entrepreneur, Erfan Khandakar, is building a number of new Digital Platforms, in cross border remittances, UK real estate management and digitizing the restaurant and hospitality sector. In one project, he is partnering with a large Chinese AI company looking to launch a new digital payments and order management system in the UK. There are many more such Digital entrepreneurship opportunities if we are willing to think about leveraging new technology platforms.

Such trends provide new opportunities for UK businesses and individuals who have suffered during Covid to re-invent themselves and embrace new opportunities in the digital economy ecosystem. The mantra in 2021 for economic regeneration post Covid should be “Build Back Better”, and embracing the new Digital Economy is the key. Policymakers should support businesses adopting new digital platforms and, perhaps more importantly, come up with innovative support schemes to create an explosion of new digital entrepreneurs. Let’s look beyond “Elastoplast Economics” and leverage technology to emerge from the pandemic with sustainable digital economic growth.

Ifty Islam

CEO

Pathfinder